Personal loans

Please read this information and make sure this is the right personal loan for you

Welcome to Premier Finance! We’re thrilled that you’re interested in our personal loans. We understand that sometimes unexpected expenses come up, or you might want to celebrate a special occasion with your loved ones. Whatever your needs may be, a personal loan can be a great way to get the cash you need to make those dreams a reality.

Our team works with a panel of trusted lenders to help you find a suitable loan that fits your unique financial situation. We offer a free online service that makes it easy and convenient for you to apply and connect with our network of lenders.

With just one application, you can link up to multiple lenders to see who can assist you with a loan. Our goal is to save you time and resources by helping you get the right funding for your needs. You can rest assured that you’re in great hands with Premier Finance!

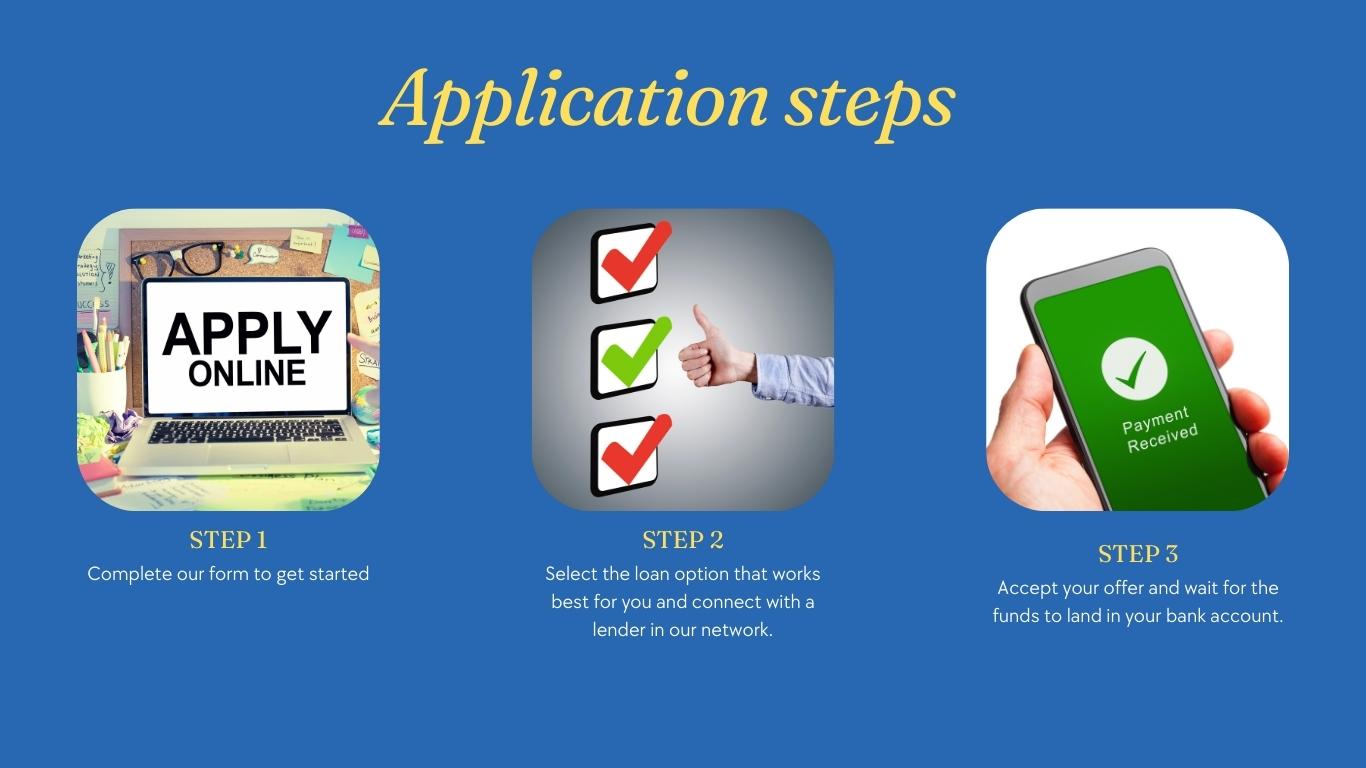

Here’s how our personal loan process works:

Step one: Fill out our application form, and our team will conduct an in-house credit check to see if you meet the criteria to apply with our network.

Step two: If you pass our pre-vetting process, you’ll be directed to a link to complete your application with our network. You’ll have access to over 10 lenders, including major banks and private lenders.

Please note that this offer is only available to those who haven’t applied with our network in the last 60 days. If your application isn’t a duplicate, you’ll receive a list of lenders that could make you an offer. You can then select the loan that best suits your needs and complete your application online for a swift pay-out.

At Premier Finance, we assist with personal loans ranging from R4000 to R250 000. We want to help you take the next step towards a better life by providing you with the financial support you need. Apply with us today and take the first step towards achieving your dreams!

We can assist full time employed clients only. We unfortunately cannot assist pensioners, self-employed or commission earners.

If you are self employed please consider our unsecured business loans: https://premierfinance.co.za/unsecured-business-loan/

We work with clients that earn from R5 000 per month. Please ensure you only apply if you meet this salary requirement. We will not be able to assist you if you earn any lesser.

We may not assist you with a loan application if you are under a debt management program. That includes administration, debt review or sequestration.

The interest rate will be from 20% – 30%. The rate you receive is based on your personal financial profile and will be discussed with you in your offer.

Your loan approval depends on your credit profile and affordability. Clients that pass the pre-approval check will be contacted to discuss your application and offer. You will receive an email from us with the outcome of your application.

Clients that meet the criteria for an offer will need to submit the following documents:

1. Clear copy of your id document

2. Your latest 3 months bank statement

3. Your latest payslip

If you are looking for vehicle finance please visit https://premierfinance.co.za/vehicle-solutions/ to find out more about our vehicle finance solution.