Every business needs capital to grow—whether it’s to hire staff, expand operations, stock up on inventory, or invest in marketing. But before you start searching for funding, you need to understand your options and what each one really means for your business in the long run.

There are two main ways to raise capital: debt and equity. Each option has its pros, cons, and consequences—and the best choice depends on your business stage, risk appetite, and goals.

Let’s break it down.

What Is Debt Financing?

Debt financing means borrowing money—usually through a loan—with a fixed repayment plan and interest. It’s one of the most common ways to raise working capital.

Key Features:

- Instrument used: Loan

- Investor income: Interest

- Capital repayable? Yes (monthly repayments)

- Investor’s concern: Can the business afford to repay the loan with interest?

Debt can be:

- Secured: Backed by assets (like vehicles or property) = lower risk = lower interest rate

- Unsecured: No collateral = higher risk for the lender = higher interest rate

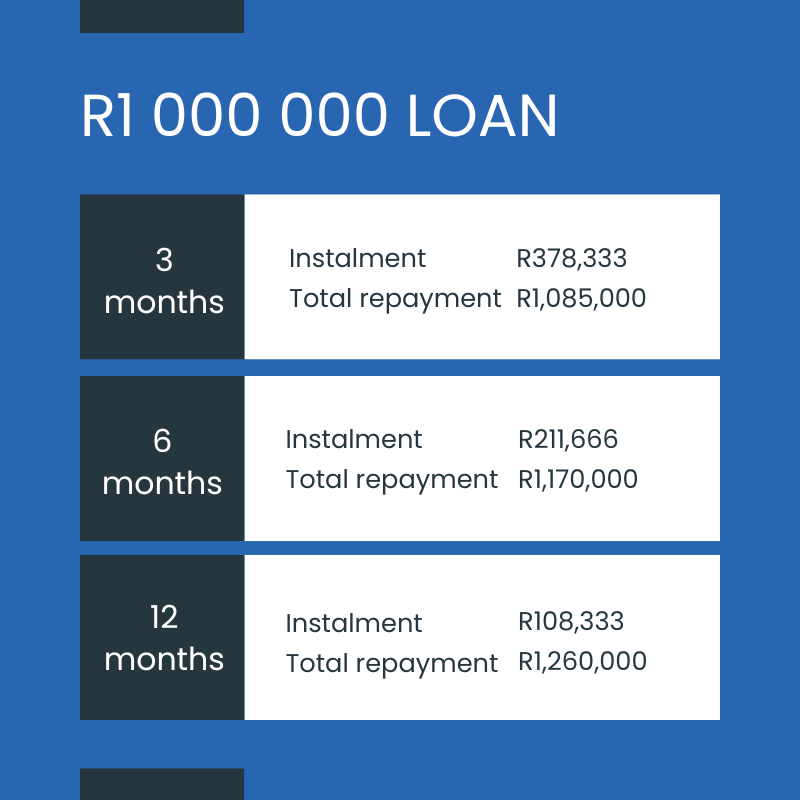

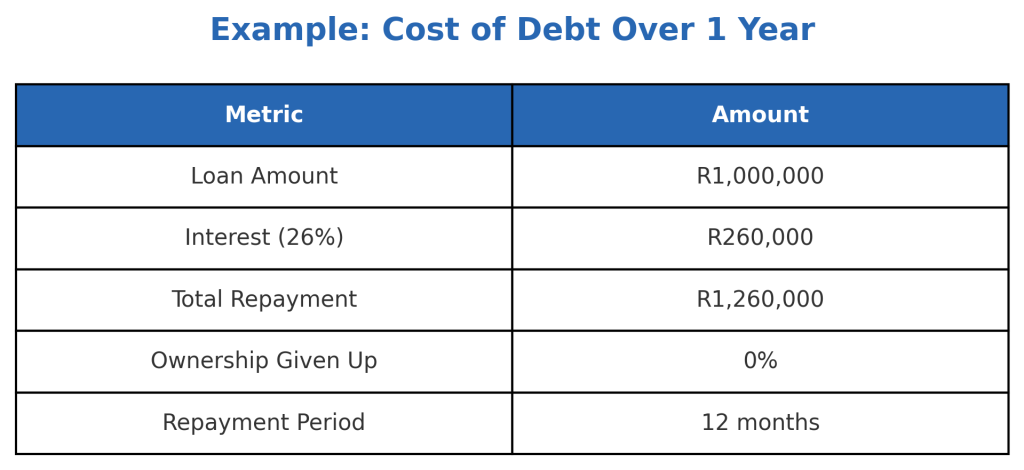

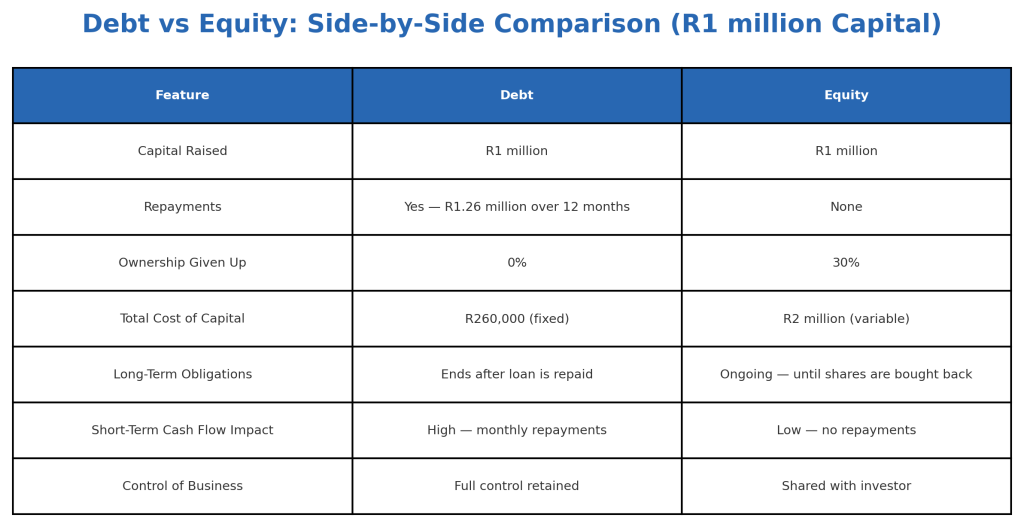

For this example, we’ll use an unsecured loan of R1 million at an annual interest rate of 26%, repaid over 12 months.

This means the business gets R1 million now, makes monthly repayments of about R108,333, and retains 100% ownership. Once the loan is paid off, the obligation ends.

What Is Equity Financing?

Equity financing means raising capital by selling a percentage of ownership in your business. This option is often used by startups or growing businesses that may not have strong cash flow but have high future potential.

Key Features:

- Instrument used: Shares

- Investor income: Dividends and/or capital gain

- Capital repayable? No (unless business is liquidated)

- Investor’s concern: Will I receive dividends, and how will I exit?

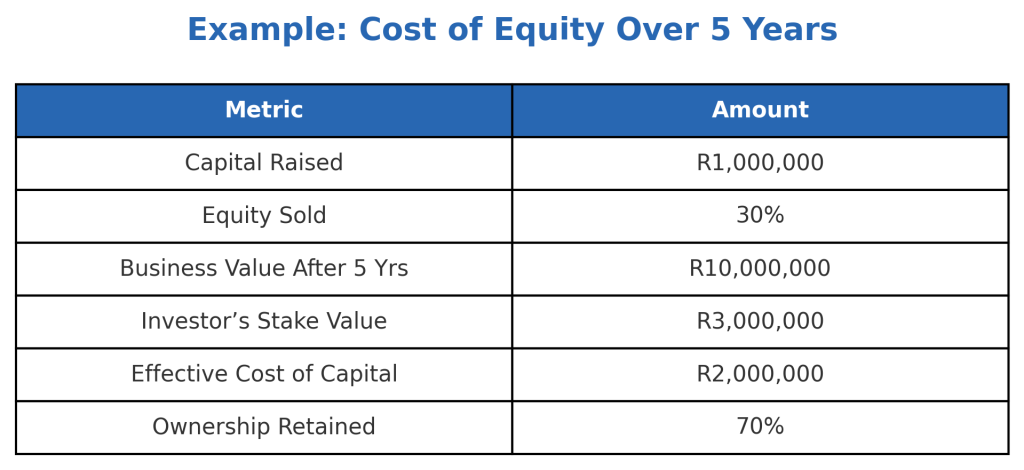

In this example, the business sells 30% equity for R1 million. Let’s say your business grows over five years and is now valued at R10 million.

You didn’t repay a cent during the five years, but the investor now owns R3 million worth of your company. Unless you buy them out, you’ll continue to share profits indefinitely.

Which Option Makes More Sense?

It depends on your business goals, risk profile, and growth stage.

Choose Debt if:

– You want to keep 100% ownership

– Your business generates consistent income

– You can manage monthly repayments

– You want to limit long-term cost of capital

Choose Equity if:

– You don’t have the cash flow to repay loans

– You’re comfortable sharing ownership and profits

– You need a strategic investor who can open doors

– You’re aiming for long-term growth over short-term control

Final Thought

Debt is cheaper if your business grows. Equity is safer if it doesn’t.

Debt gives you access to capital now—and lets you keep control of your business. Once it’s repaid, the relationship ends. Equity gives you breathing room now, but the cost grows as your business becomes more successful.

If you’re unsure which route to take, speak to a finance consultant who understands your industry and funding options. Raising capital is more than just money—it’s a long-term decision that affects the future of your business.