Cash flow is the lifeblood of any business. Yet for many South African companies, especially those operating on extended payment terms, the reality is harsh: you deliver the goods or services, issue the invoice, and then wait — sometimes 30, 60, or even 90 days — for payment.

In the meantime, expenses don’t stop. Salaries, rent, supplier invoices, and operational costs continue to fall due. Without access to quick, flexible capital, many businesses are forced to pass on growth opportunities or, worse, take on expensive debt that erodes profitability.

Traditional factoring — selling your invoices to a finance company for an advance payment — has long been seen as a solution. But it’s far from perfect.

The Problem with Traditional Factoring

Most factoring providers:

- Advance only 70–85% of the invoice value, meaning you still have a funding gap.

- Require you to cede your entire debtor’s book, leaving you with little control.

- Tie you into long-term contracts with minimum usage requirements.

- Charge multiple fees: activation fees, monthly admin fees, non-usage fees, and sometimes even penalties.

- Demand heavy security, such as pledging assets or equity.

- While factoring can improve cash flow, it often comes at the cost of flexibility, control, and transparency.

The Premier Finance Alternative: Flexible, Client-Centred Factoring

At Premier Finance, we believe there’s a smarter way to unlock the cash tied up in your receivables — one that works with your business model, not against it.

Our funding partner’s revolving working capital facility is a self-replenishing pool of available capital that you can draw from whenever you need it. You’re essentially accessing a portion — or all — of your future revenue today, at a simple discount.

How It Works

- You apply for a facility limit based on your receivables and business performance.

- Once approved, the limit becomes available for you to draw against as needed.

- When you have an invoice you’d like to factor, you choose how much of it to unlock.

- Our partner advances up to 100% of the invoice value, minus the agreed discount fee.

- When your customer pays the invoice, the facility replenishes automatically.

This cycle can repeat indefinitely — giving you ongoing access to working capital without taking on traditional debt.

Why It’s Not a Loan

- No fixed repayments — your costs are settled from the invoice payment, not your existing cash.

- No compounding interest — you pay only the agreed discount fee.

- No maturity date — you can keep the facility open for as long as it’s useful to your business.

- No long-term lock-in — if the facility isn’t working for you and no arrears exist, you can exit at any time.

Key Advantages Over Traditional Factoring

1. Higher Advance Rate

Our partner releases up to 100% of your receivable, minus the discount fee, compared to the 70–85% typical of most factoring companies.

2. Full Control

- Factor the entire invoice or just a portion.

- Use the facility as often or as little as you choose.

- Manage your cost by controlling the timing of your requests.\

3. Simple, Transparent Pricing

The pricing is dynamic and can be tailored to your industry and payment cycles.

- An upfront fee applies for the first few days.

- A daily rate is charged thereafter until the invoice is settled.

Example:

Upfront rate: 1%

Daily rate: 0.1%

On a 30-day invoice: 1% + (0.1 × 27) = 3.7% total cost

4. Growing Benefits

The longer you use the facility, the lower your rate can become.

A Real-World Example

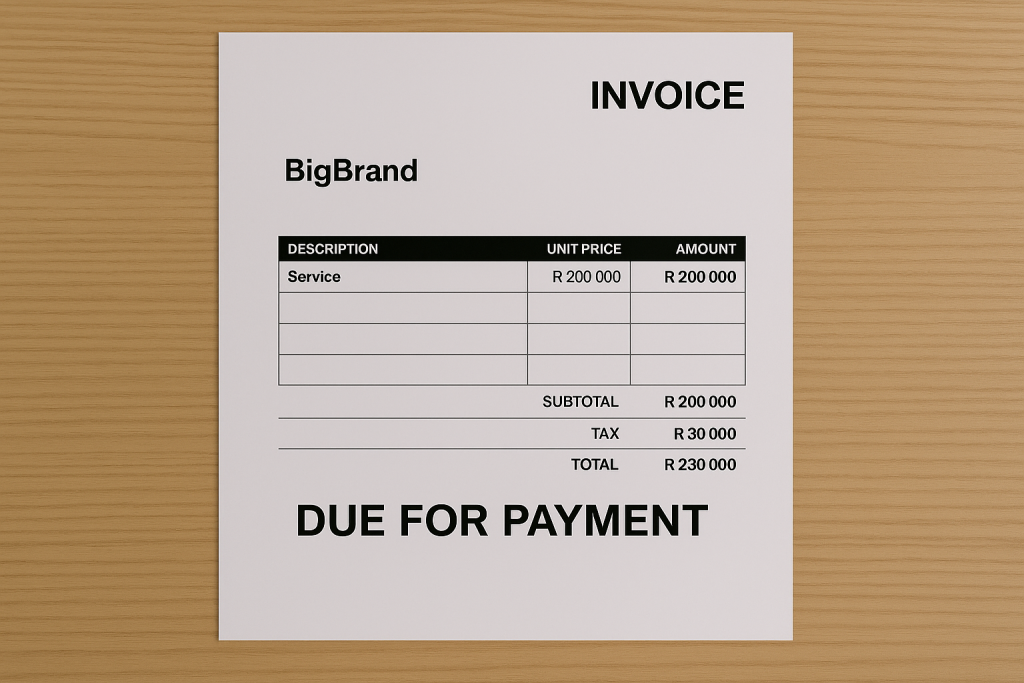

YourComp, a B2B services company, has a R1 million facility.

- They invoice BigBrand for R200,000 with 30-day payment terms.

- Salaries and rent are due, but payment is still a month away.

- They choose to factor the full invoice.

- Our partners advance R192,000 the same day.

- The facility balance drops to R800,000.

- When BigBrand pays the invoice, the full R1 million limit is restored, ready for the next request.

Who Qualifies

- South African B2B businesses (or the B2B division of a larger company).

- Companies with receivables to credible counterparties.

- Businesses looking to protect cash flow without heavy security requirements.

The Application Process

- Understand the facility — We explain how it works and assess if it’s right for you.

- Submit documents — We request financial and operational details.

- Decision in 2 working days — Once we have all the documentation, our partner will provide feedback or an offer.

- Onboarding — They set up your account, assign a dedicated account manager, and provide online portal access.

- Go live — Once your collection mechanism is in place, you can request funding immediately.

Flexible Collection Mechanisms

To settle the facility when your debtor pays, there are three secure, efficient options available:

- Direct Payment — Update debtor bank details to send payments directly to the collection account.

- Dedicated Collection Account — Held in your name but with controlled access for security.

- GPay Integration — Software that sweeps debtor payments from your account directly to the facility provider.

The Special Opportunities Fund (SOF)

If your business is still strengthening its balance sheet, the SOF facility offers a smaller, short-term limit (R250,000–R750,000) at a fixed rate. It acts as a trial run to build trust before upgrading to a larger, more affordable facility.

Why Businesses Choose Premier Finance’s Network for Factoring

- Control over how much you factor and when.

- Speed — same-day payouts after request approval.

- Cost-efficiency — pay only for the days you use the funds.

- Flexibility — adapt usage to your cash flow cycles.

- Support — direct access to your account manager, not a call centre.

With this approach, you’re not just filling cash flow gaps — you’re unlocking the freedom to grow, take on larger clients, negotiate better supplier deals, and never turn down an opportunity because of timing.

Conclusion: Factoring Evolved

Factoring shouldn’t be a one-size-fits-all product that forces your business into rigid terms and high costs. With our partner’s revolving working capital facility, you get the flexibility to factor on your terms, the transparency to know exactly what you’re paying for, and the confidence that your cash flow will be protected.

Whether you want to take on bigger contracts, negotiate better supplier deals, or simply stop worrying about when invoices will be paid, this is a better way to factor — one designed to help your business grow, not hold it back.

Apply Today

If your business issues invoices to credible B2B clients and you’d like to turn those invoices into immediate working capital without the usual restrictions of factoring, let’s talk.

📞 Call Premier Finance on 021 780 1046

📧 Email us at judy@premierfinance.co.za

💻 Or apply online here: https://premierfinance.co.za/invoice-financing/

Stop waiting for payment terms to run their course. Start using a facility that works with your business, not against it.