We recently received a question on WhatsApp from a client:

“What credit score do I need to qualify for a loan offer?”

It’s one of the most common questions we receive — and also one of the most misunderstood. Most people assume that a good credit score automatically guarantees a loan. But while your credit score is important, it’s just one part of the story.

At Premier Finance, we help South Africans repair and restore their credit records so they can qualify for better loan offers. Here’s what you need to know if you’ve been declined or told your score is too low.

1. Your Credit Score Is the First Filter, Not the Final Decision

When a lender processes your ID number, the first check is your credit score. It’s the entry gate. If your score is below the lender’s minimum threshold, your application won’t move forward to assessment — no matter how strong your affordability looks on paper.

Think of it this way:

• Your credit score determines whether your application is even reviewed.

• Your debt-to-income ratio and affordability determine whether you receive an offer.

If your score is under 600, most funders won’t move the application to offer stage because it signals that there are negative factors on your report — such as arrears, defaults, or judgments. The only way to move forward is through credit repair, where these issues are identified and resolved.

2. Understanding the Role of Your Credit Score

Many South Africans apply for loans with scores between 500 and 600, believing they still have a chance — but this range almost always results in a decline.

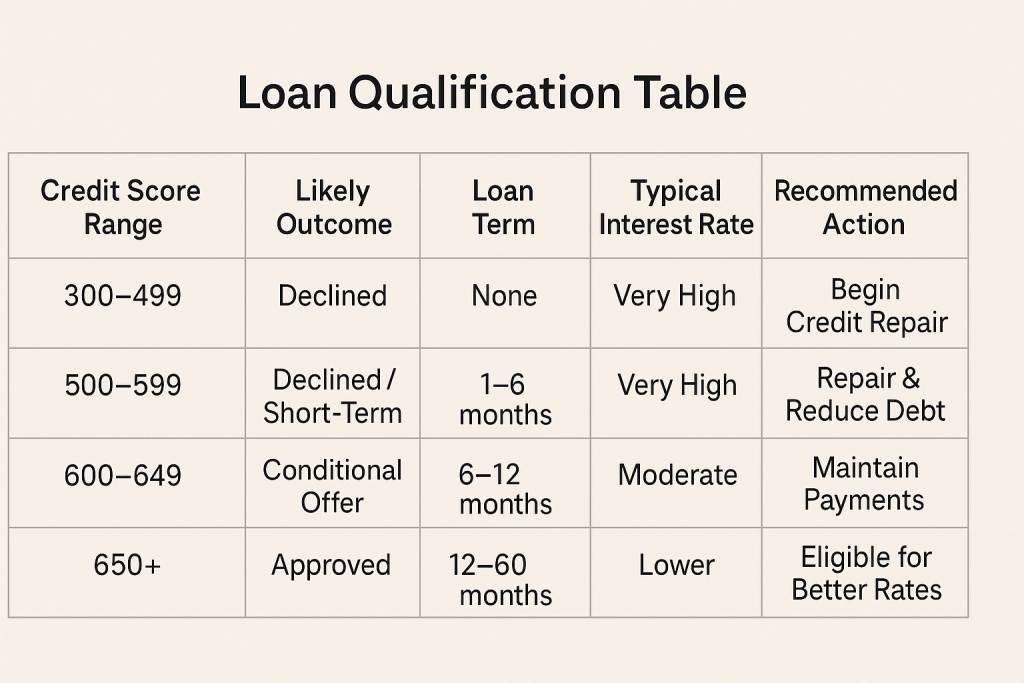

In some cases, a score around 590 may qualify for a short-term loan (up to six months), but these offers come with high interest rates and short repayment terms. For long-term loans — such as 36–60 months — a score above 630, preferably 650+, is needed to move past assessment and qualify for better interest rates.

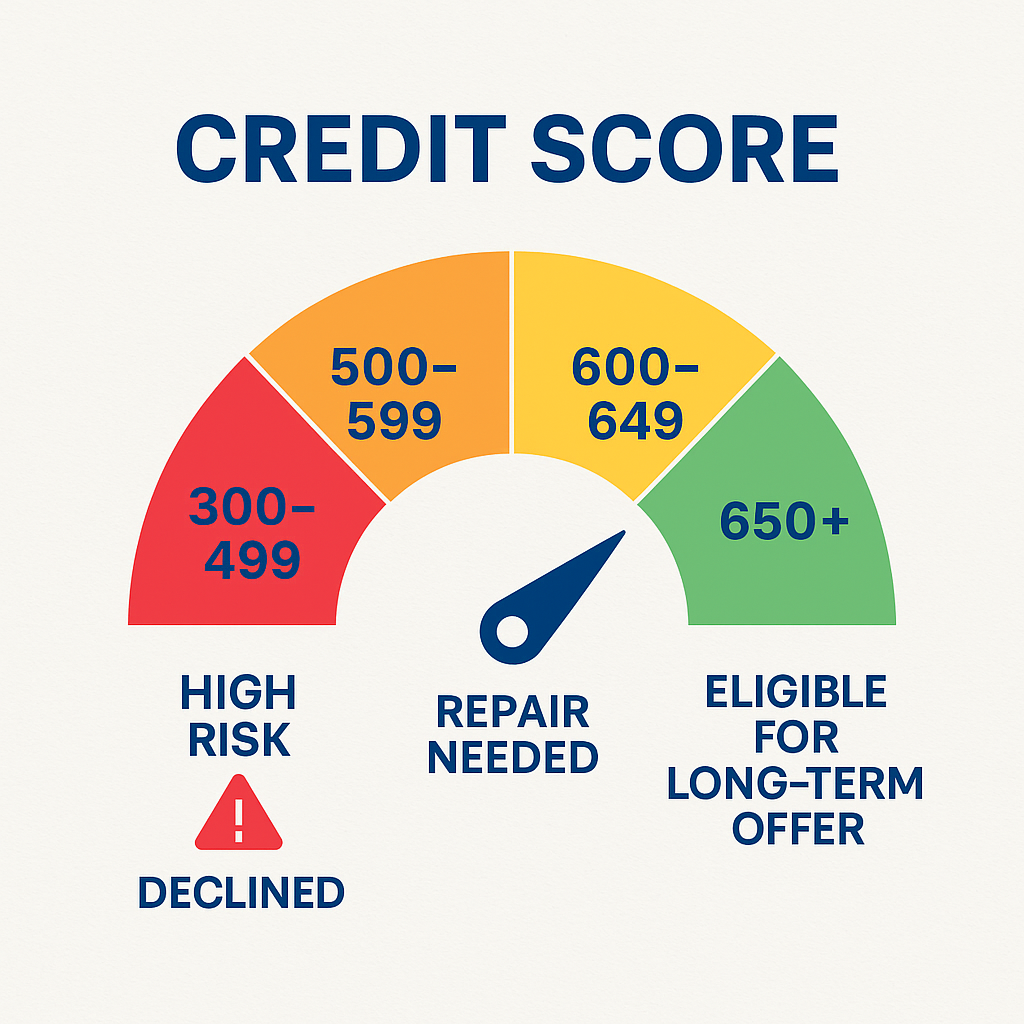

Below is a guide that helps you understand how credit score impacts loan eligibility:

3. Why Scores Drop — and How to Fix Them

When we review credit reports, the same issues come up repeatedly:

1. Arrears and missed payments — falling behind affects 35% of your score.

2. High credit utilisation — using over 50% of your available limit lowers your score.

3. Too many credit checks — multiple applications reduce your score slightly.

4. Defaults, judgments, and debt review flags — these must be legally removed before any funder can assist.

The first step to fixing these is understanding why your score is low. That’s why every credit repair journey begins with a free assessment.

4. What Happens During a Credit Repair Assessment

The process begins with a free consultation, where our legal partners review your credit report and identify what’s causing your low score.

For complex cases, you may be asked to do a 4-in-1 credit report. This gives an in-depth view across all four credit bureaus (Experian, TransUnion, Compuscan, and XDS), helping our team pinpoint issues that appear on one bureau but not the others.

Once the report is analysed, our legal team will:

- Identify arrears, defaults, or judgments that can be cleared or rescinded.

- Prepare a quote with a payment plan suited to your circumstances.

- Provide a roadmap to restore your credit score and improve your loan eligibility.

Every client’s situation is different — which is why we don’t give generalised advice without first assessing your credit profile.

5. Real Case Studies from Our Credit Repair Network

Case Study 1: Debt Review Removal

A client approached us with a debt review flag on their name, but all their debts were fully up to date.

After assessment, our legal team confirmed they qualified for debt review removal.

Within 30 days, all four credit bureaus updated their records. Three weeks later, the client applied for new credit and was successfully approved.

Case Study 2: Score Rebuild from 500 to 650

Another client came to us with a score near 500, a high debt-to-income ratio (80%), and multiple arrears. He wanted to buy a property but couldn’t qualify.

We assisted him with mediation and repayment negotiation, securing lower interest rates with his creditors.

He channelled the savings into repaying his arrears and cleared over R100,000 in 16 months.

His debt-to-income ratio dropped to 40%, his score improved steadily, and after three months he was approved for a credit card — paving the way for home loan eligibility.

These examples show that credit repair is not an overnight fix, but the results are worth the effort.

6. Misconceptions About Credit Scores and Loan Approval

One of the biggest misunderstandings we see is the belief that a good score guarantees approval.

In reality, the score gets you an assessment, but affordability gets you an offer.

Clients also believe there’s a special loan for low-score individuals. Unfortunately, this belief often leads people into loan scams targeting desperate borrowers.

Lastly, many assume that paying off debt instantly fixes their score. It doesn’t. Credit bureaus need time to receive and update repayment data. This can take weeks — or months — depending on the creditor.

7. The Connection Between a Clean Record and a High Score

To achieve a high credit score, you need a clean credit record.

The two are directly linked. Lenders use your score as a summary of your credit record — a shortcut to identify risk quickly.

Applications from clients with low scores are automatically filtered out before human review.

That’s why continuously applying for credit with a poor score wastes time and further damages your record.

Instead, use that energy to repair your credit first.

8. The Way Forward – Repair Before You Apply

At Premier Finance, we’ve helped many South Africans move from “declined” to “approved” by guiding them through the credit repair process.

It starts with one simple step — your free credit assessment.

Our legal partners will check your report, identify what can be fixed, and explain the process and costs clearly before any work begins.

✅ Ready to See What’s Holding Back Your Score?

Take your free credit assessment today and find out what’s affecting your loan eligibility.

👉 Book Your Free Assessment Online: https://premierfinance.co.za/credit-repair/

💬 Prefer WhatsApp? Chat with Us: https://wa.link/mvbuhw

Please note: Advice is provided by our legal team after your assessment is completed.