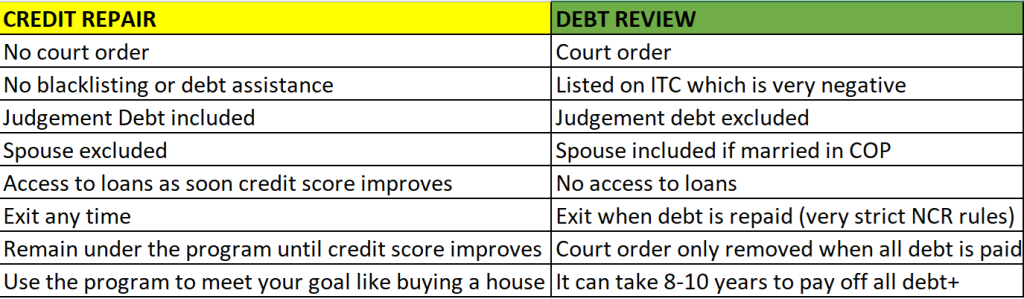

Credit repair vs. Debt review which one is better? In the realm of financial assistance, it’s crucial to have a clear understanding of the various services available. This will enable you to navigate your unique circumstances. We have noticed a recurring issue where clients confuse credit repair with debt review. This leads to missed opportunities for effective help. To address this confusion, we aim to shed light on the key differences between these two services. This allows you to make informed decisions based on your specific needs.

Credit Repair: Rebuilding and Empowering Your Credit

Credit repair is a service tailored to individuals who aspire to improve their credit records. They strive to increase their credit scores, and access more favourable credit opportunities. It is the ideal solution for people who want a stronger financial foundation. It empowers them to overcome past financial challenges.

The credit repair process entails a team of dedicated experts who examine your credit report. They look for inaccuracies, errors, or outdated information. By utilizing a range of strategies and techniques, our team works to address these issues. This includes negotiating with creditors if necessary. The goal is to help you resolve any negative aspects of your credit history. This results in a healthier credit profile and enhanced creditworthiness. With an improved credit record, you increase your chances of obtaining better credit terms. You can seize new financial opportunities.

Debt Review: Safeguarding Assets and Finding Financial Stability

Debt review is a specialized service designed for individuals facing significant financial stress. They seek to protect their valuable assets, such as their home or car, from repossession. Debt review involves engaging in a formal legal process. It’s aimed at renegotiating payment terms with creditors.

During the debt review process, an experienced debt counsellor will work closely with you. This is to evaluate your financial situation and develop a comprehensive repayment plan. The plan is intended to alleviate financial strain. It ensures that you can continue making affordable payments while protecting your assets. It is important to note that debt review requires committing to a court order. This will result in restrictions on accessing further credit. It’s designed for those whose primary focus is safeguarding their assets. Debt review can be an effective solution in finding stability.

Choosing the Right Path for You

Understanding the differences between credit repair and debt review is crucial. It helps you determine the most suitable option for your unique circumstances.

Credit repair is the recommended path for those focused on accessing more credit. There is no court order, so you use the process as long as you need it. Improving your credit record will enhance your financial prospects over time. You can reapply for credit once your credit score is above 615. Kindly note that approval will be based on your affordability to service the new loan.

Debt review is a more appropriate choice if your priority is to protect valuable assets. If you are willing to forgo access to credit, you can protect your home or car from repossession.

It is important to consider your current financial situation and goals when making this decision.

Conclusion

We hope this article has provided you with a clear understanding of the differences between credit repair and debt review. Our aim is to empower you to make informed choices about the services that align with your financial needs and goals.

Should you have any further questions or require assistance, our dedicated team is here to help.

We have partners that can assist you with either debt review or credit repair.

Use the buttons below to learn more about these two financial tools.