Fast-tracking your loan approval to access funds may seem like an elusive dream for many. But understanding how to maintain good credit can turn this dream into a reality. In this article we shed light on why this is crucial. You will also discover actionable tips to achieve a faster loan approval process.

The Power of Maintaining Good Credit

Maintaining healthy credit is essential, as it influences your loan approval prospects. Lenders focus on your credit score when considering any loan application. By assessing your credit score, creditors gauge your risk level and creditworthiness. A higher credit score increases your chances of securing a loan. It also grants you access to better interest rates.

Preparing for Loan Approval

Prioritizing the improvement of your credit score before applying for credit is vital. Lender’s approach new credit applications with caution. That is why making a positive first impression is crucial for loan approval. To assist you in this endeavour, we’ve compiled eight practical tips to keep your credit score in check.

Fast track your loan approval through maintaining a good credit score

- Obtain a Copy of Your Credit Report. Begin by assessing your credit report to identify your current position. This step is crucial to help you work on a plan. It also helps you identify inaccuracies that you can rectify. This will help you improve your credit score in record time.

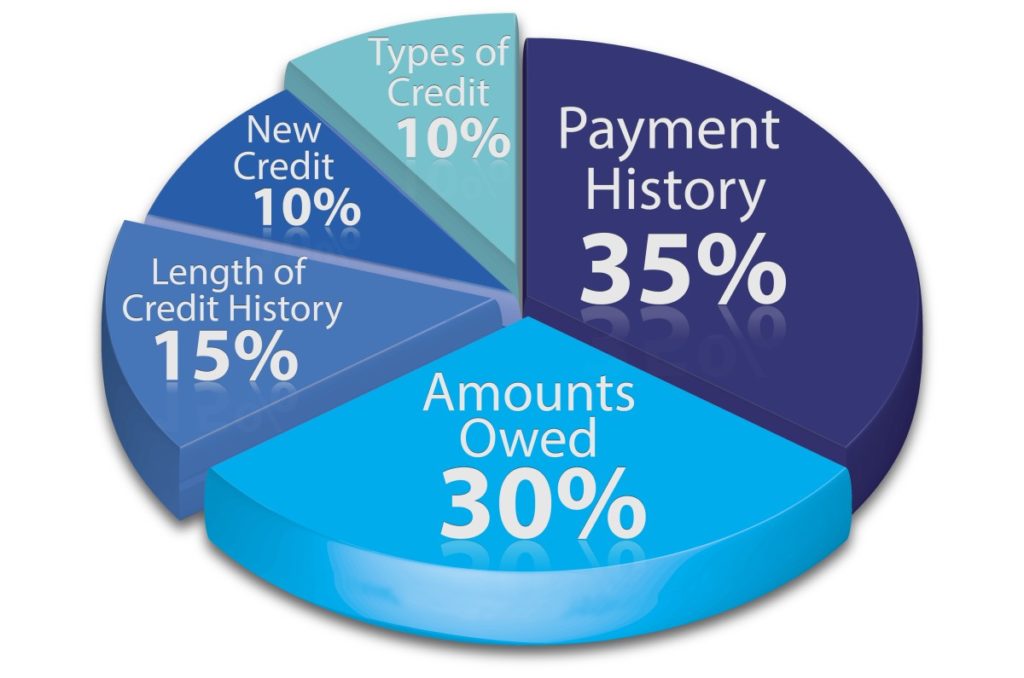

- Timely Payment of Accounts. Your payment history contributes around 35% to your credit score. Hence, it is imperative to pay your accounts on time. In case of difficulties, communicate with your creditors. Explain your situation and explore alternative payment arrangements. If you are behind on payments for a few months, it’s best to seek advice from a professional debt adviser. Late payments incur interest that can be reduced if you ask for professional help.

- Cut Late Payments. Occasional financial constraints can make timely payments challenging. If you fall behind aim to keep late payments within 30 days. Many creditors do not report 30-day late payments to credit reporting agencies. Whereas payments exceeding 60 days get reported.

- Close Unused Accounts. Reducing the number of unused accounts minimizes your risk profile. This will positively impact your credit score.

- Limit Credit Checks: Each credit check negatively affects your score. If you are working on improving your score it’s best to avoid credit checks. Rather wait until your score is above 615 before applying for more credit.

- Manage Debt Responsibly. Strive to cut your total debt. This includes refraining from applying for new credit while still repaying existing debt. Aim to keep your debt payments below one-third of your gross salary.

- Steer Clear of Court Orders. Court judgments and garnishee orders can damage your credit score. And they take years to get removed. Avoiding such situations is crucial for maintaining a good credit profile.

- Focus on Credit Card Debt. Credit card interest is the most expensive. Focus on reducing your credit card balance. This serves as an effective strategy to boost your credit score. Consider paying more than the minimum instalments to speed up this process.

Conclusion

Repairing your credit score is an empowering journey that holds immense benefits. By taking proactive steps you can improve your creditworthiness. This will help you fast track your loan approval process. It’s your key to unlock funding for life-changing opportunities. Begin your path towards a brighter future by utilizing the power of a good credit score.

Invest in your dreams and leverage your creditworthiness. It’s your passport to secure the financial support you need.

If you want expert assistance to improve your credit score- consider our credit repair solution