In this blog we will break down our personal loan process so that you know what to expect when you need access to fund in a hurry.

Most people need financial help at some point in their life. Whether it is to fix your motor vehicle or pay tertiary education enrollment fees, a personal loan could help when you are in financial need.

We understand that the loan process can be daunting but if you understand the process it won’t be a hassle. and your application can be quick and straight forward so that you can receive your funds in your account sooner.

1. Check if you qualify to apply

Personal loans have strict lending rules governed by the National credit act. The Financial advisory & intermediary services act (FAIS) also ensures lenders maintain transparency with you throughout the application process.

It’s thus important that you meet the lending requirements to be a candidate for more credit.

Before you complete our personal loan application form you should ensure you are eligible to apply:

- You need to have a permanent employment for 6 months that pays at least R5000 per month.

- A valid South African identity

- You cannot be under debt review or busy with a debt review application

If you meet all the above requirements, then you can prepare for your application. A good place to start is to make sure you have all the necessary documentation. You will need:

- Your most recent pay slip

- A clear copy of your id for identification

- Latest 3 months bank statements

Now that you have prepped yourself you can continue and start with your application.

2. Complete your application on our website

We use online tools that help us track your personal loan application. This ensures that we protect your personal information and we have consent to assist you. It’s for this reason that we only accept applications completed on our website.

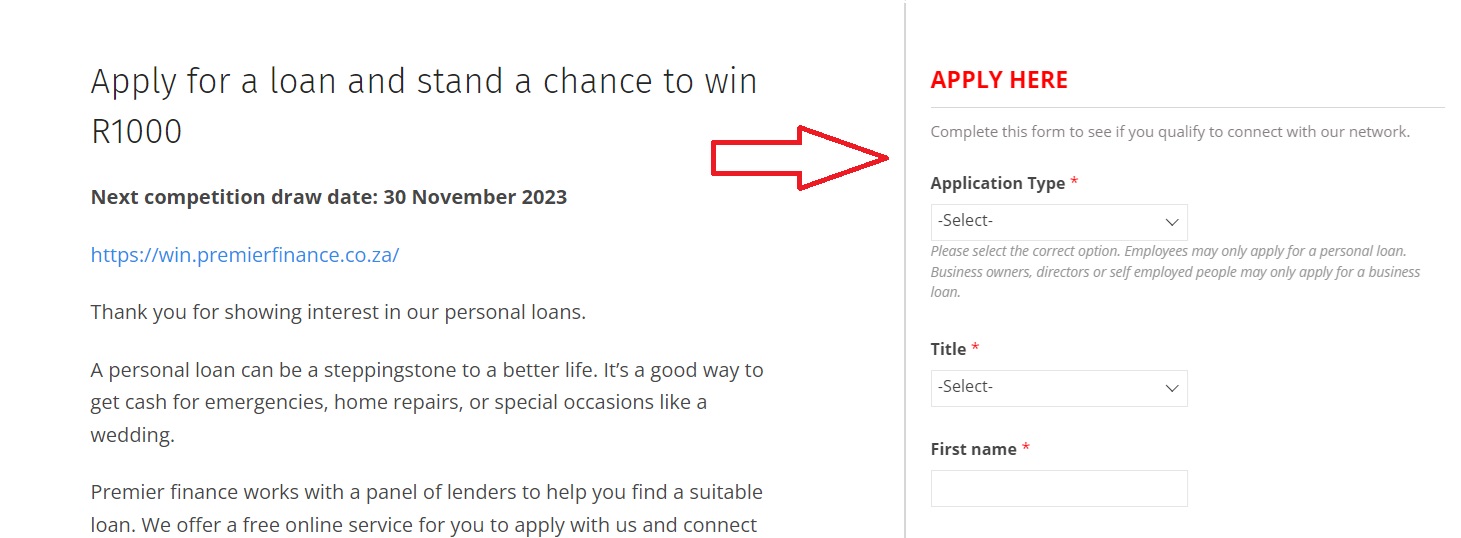

Visit https://premierfinance.co.za/personal-loans/ and fill out the form on the top right of the page. (see image below)

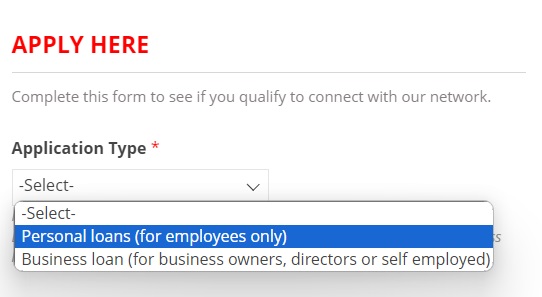

For question1 (application type) select Personal loans (for employees only) for the personal loan application to appear. You will complete all your information until you reach the last page and press submit to send us your details.

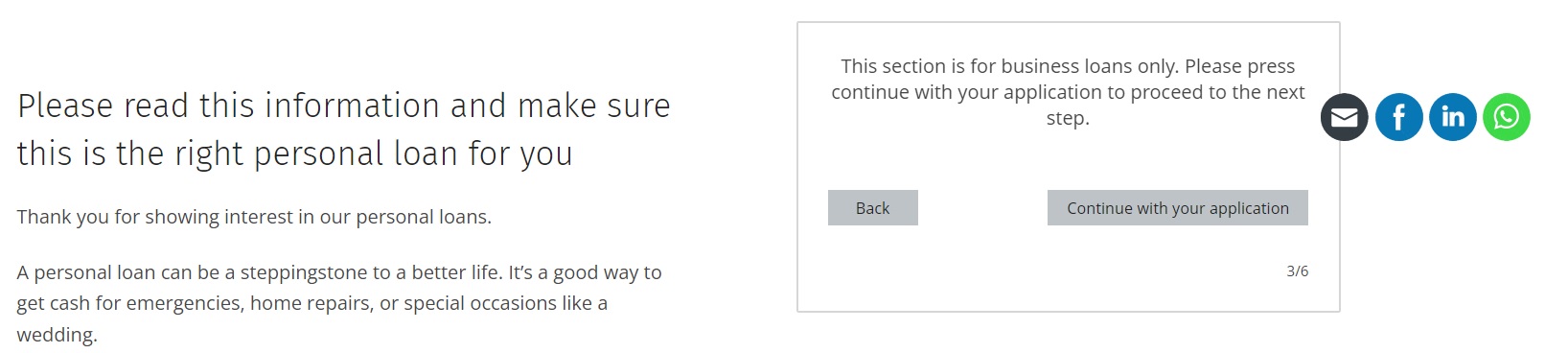

Kindly note that you will reach a point of the application where a message pops up that says: “this section is for business loans only. Please press continue with your application to proceed to the next step.” This information is only necessary for business finance applications. Please press the button 3 times to continue with your personal loan application.

At this stage of the process you have completed our application for an internal check to see if you qualify to apply with all the lenders in our network. Kindly note that for the internal check process no credit check is processed on your id number. We use the information provided to ensure that you meet the lender’s minimum requirements to apply for a loan.

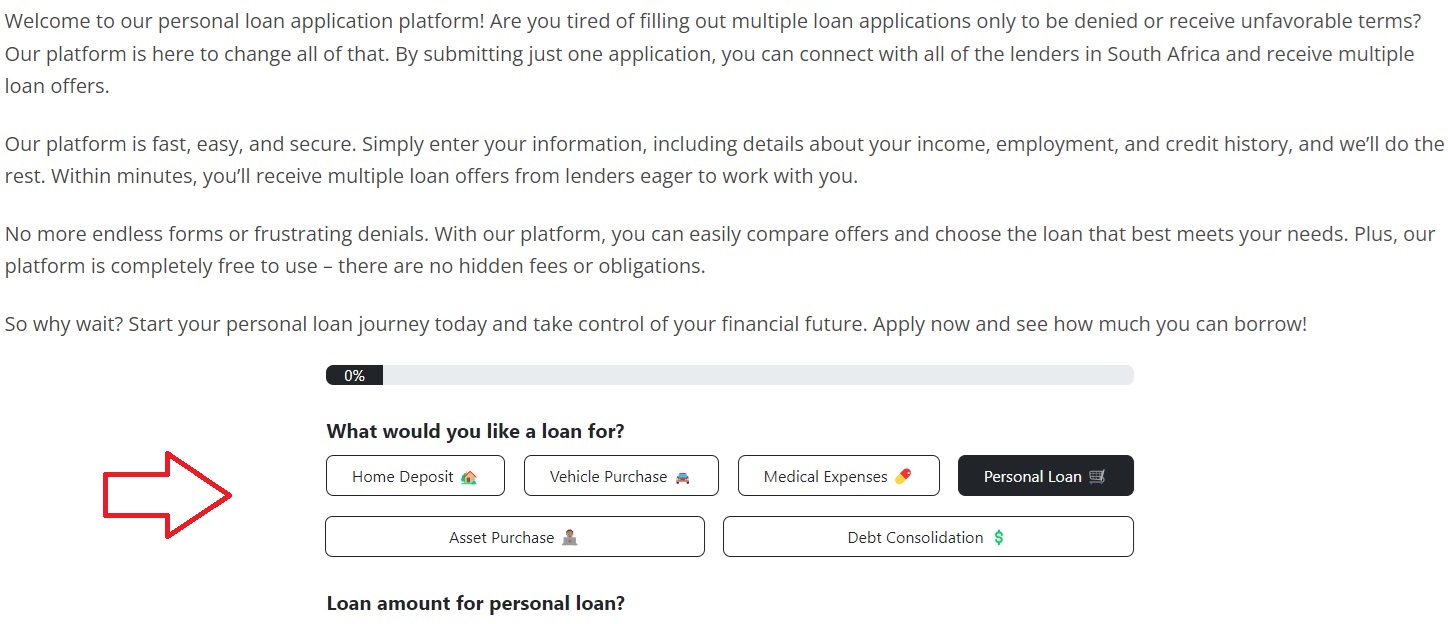

If you pass our internal check you will be able to apply with our network of lenders that you can access through an online system. By completing a few questions your application will be sent to all the banks and private lenders and you will be able to select the best offer that suits your needs.

You will be directed to the page to complete your application and you will also receive an email with the link to apply incase you close your browser too soon.

3. What to expect after completing your application with our network

Once you have completed the above form you will receive one of the following outcomes

A. Your application was accepted

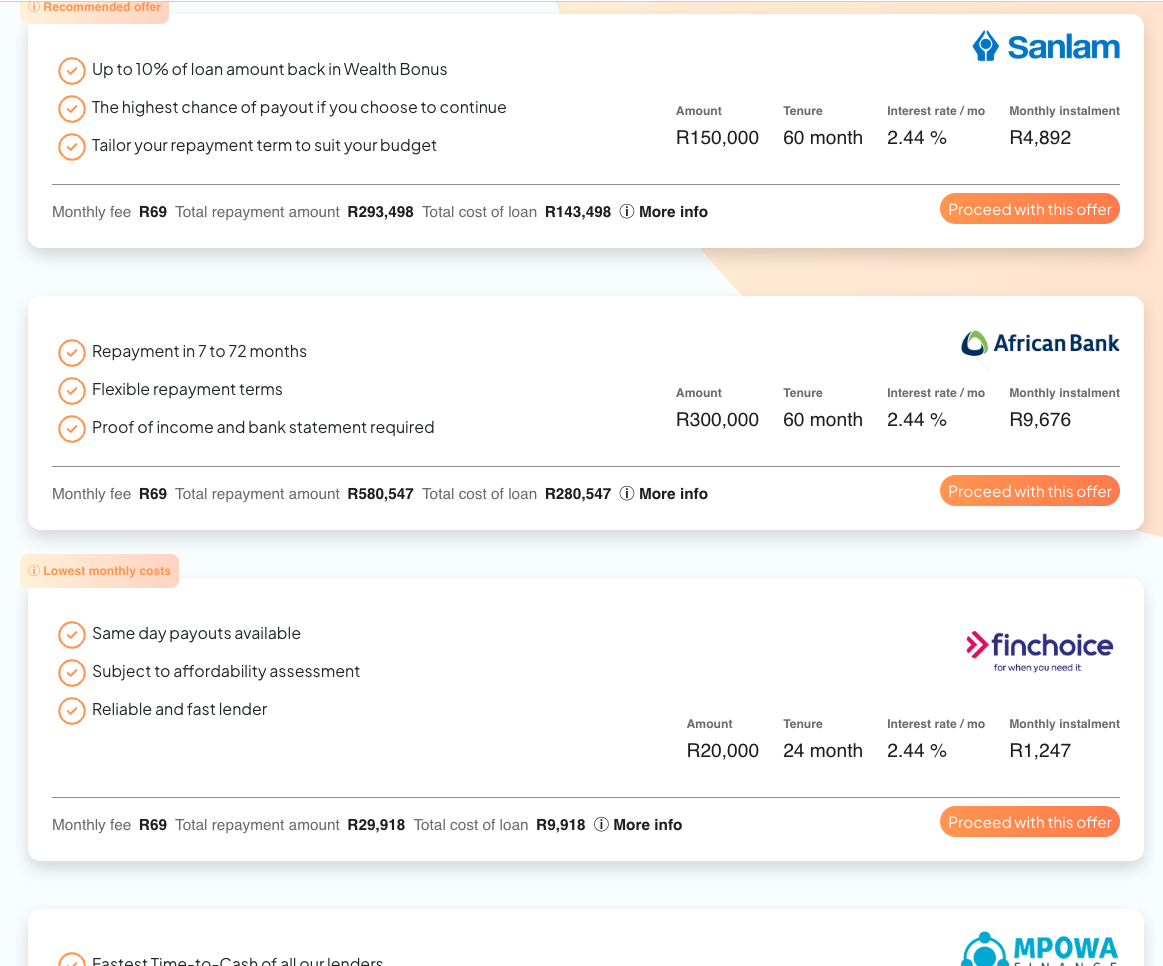

If your credit score checks out and you have not applied with our network within the past 60 days you will receive a list of offers you can apply for. The page you will receive will look similar to this

Note that each lender in the network has different lending criteria so you will only receive offers that are applicable to your credit profile. You will be able to compare the different offers and monthly repayments and select the offer that best suits your needs. To accept the offer you need to click on the “proceed with this offer” button and then complete your application directly with that lender. You will be guided to ensure that you receive a payout in no time.

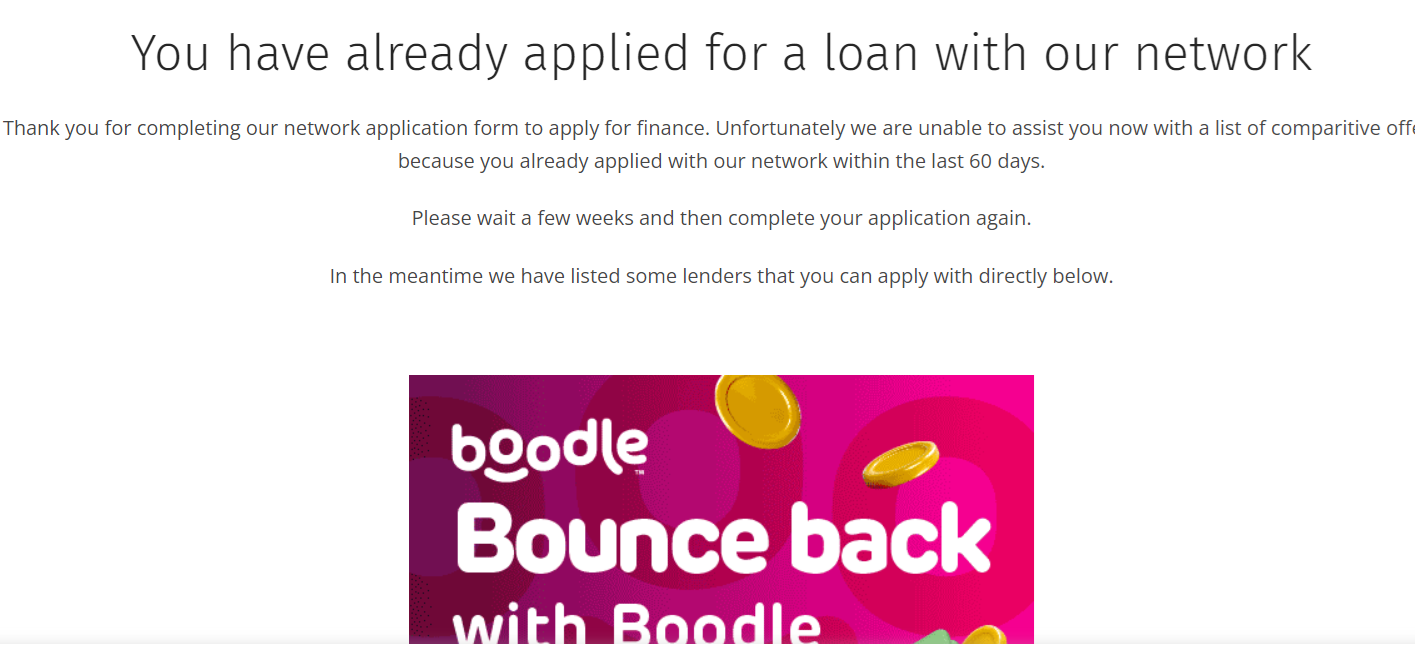

B. Duplicate application

If you already applied with our network within the last 60 days you will land on a page that says duplicate application. This means you will not receive a list of offers but you can still apply with some lenders directly. We have listed websites for more loan lenders and compeitions that you can visit.

C. Debt management program

When you land on this page it means that you have a debt review flag on your credit record and you will not be able to apply for any loan at this point. If you have completed your debt review then it would be a good idea to chat with our credit repair team to see if they can help you clear your credit record.

4. Pre-approval- what lenders look for?

Lenders look at your personal risk profile to see if they are able to grant you more credit.

Here are a list of factors lenders will consider for an offer:

- Current employment and employment history to ensure you have steady income

- Debt repayments to find out if you are currently over committed.

- Your net disposable income to see if you have room to take on another installment.

- Whether you are an existing customer

- Your consumer risk profile gets evaluated through a credit score and affordability assessment

A credit score shows your history of repaying debt calculated by credit bureaus. Both you and creditors may access your score from four credit bureaus. Their names are Experian, Transunion, Compuscan and XDS. The score ranges between 330-850 and should be above 600 if you want to apply for more credit.

If your credit score is less than 600 we recommend that you chat with our credit repair team for a plan to improve your score.

Check out our website: https://premierfinance.co.za/credit-repair/

5. Approved Loans

Our partners request documents to protect you from lending more than you can repay. Credit providers collect and check all information to ensure you provide accurate information.

If all your information is correct and you qualify to take on more credit,your loan will be successful. The money is deposited into the bank account that you stipulate on the loan agreement.

In most cases you will agree to a debit order to repay your monthly loan installment.

The time it takes to process your personal application will be dependent on you. For a fast response make yourself available and return your documents within 24 hours. Remember, our partners receive applications all the time and follow a workflow system. If you do not respond they will move onto the next application and your application remains in the processing queue. That’s why it pays to be available so you can avoid delays in receiving your funds.

Thank you for reading our blog. We hope you now have a better understanding of how our personal loan application works.

If you have any further queries feel free to reach out to us on connect@premierfinance.co.za