Understanding how to calculate working capital is one of the most important skills for any business owner. Think of it as checking the financial “vitals” of your business — a quick way to see if your company can comfortably meet its short-term obligations and continue operating smoothly.

Healthy working capital ensures that cash flows freely through your operations so you can pay suppliers, manage stock, cover expenses, and respond to unexpected challenges. Too little working capital leads to pressure. Too much may mean your assets aren’t working hard enough to grow the business.

If you’re unsure how to calculate working capital or how it should guide your financial decisions, this guide breaks it down step-by-step with clear formulas and examples.

What you’ll learn

• How to calculate working capital

• What counts as current assets and liabilities

• How the working capital ratio works

• A practical South African example

• How working capital links to your funding needs

How to calculate working Capital

The standard formula used by most businesses is:

Working Capital = Current Assets – Current Liabilities

Example

If your SME has:

• Current assets: R550,000

• Current liabilities: R320,000

Then:

R550,000 – R320,000 = R230,000 working capital

This amount shows the liquidity available to cover operational costs and short-term obligations.

Knowing which financial items belong in each category is important. Here’s a quick breakdown.

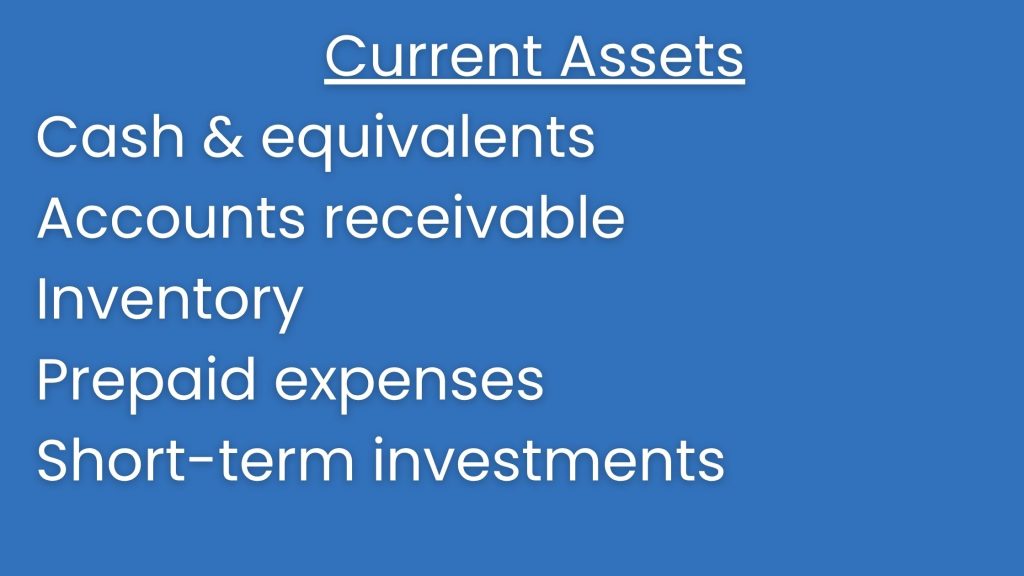

Current assets

Current assets are anything that can be converted into cash within 12 months:

• Cash & equivalents: Bank balances, petty cash, money market

• Accounts receivable: Customer invoices still to be paid

• Inventory: Raw materials, stock-in-progress, finished goods

• Prepaid expenses: Rent, insurance, subscriptions

• Short-term investments: Funds maturing within a year

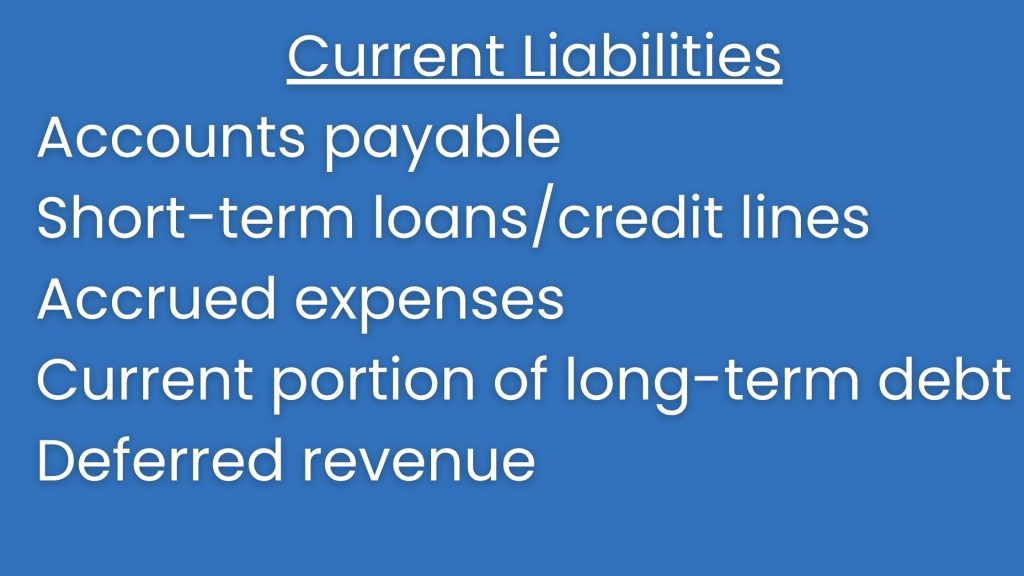

Current liabilities

These must be settled within the next 12 months:

• Accounts payable: Supplier invoices due

• Short-term loans/credit lines

• Accrued expenses: Salaries, wages, taxes, utilities

• Current portion of long-term debt

• Deferred revenue: Advance payments for future work

Managing short-term debt properly is crucial — it can quickly absorb free cash flow.

Working capital example: a South African SME

Imagine a Cape Town-based catering company handling weddings, corporate events, and private functions.

To keep operating, they need cash for:

• Fresh ingredients

• Staff wages

• Fuel and delivery costs

• Packaging

• Kitchen rental

• Equipment maintenance

If their current assets exceed their current liabilities, they can take on new events confidently. If liabilities grow too much, they may struggle to pay suppliers upfront, forcing them to turn away business.

Working capital determines whether they operate smoothly or face operational bottlenecks.

The working capital ratio (current ratio)

The working capital ratio provides deeper insight into short-term liquidity:

Working Capital Ratio = Current Assets / Current Liabilities

Let’s say the catering company has:

• Current assets: R550,000

• Current liabilities: R320,000

R550,000 ÷ R320,000 = 1.72

How to interpret it

• 1.0 and below: At risk of short-term cash flow strain

• 1.5 to 2.0: Generally healthy for small businesses

• Above 2.0: Indicates strong liquidity but possibly under-utilised assets

How to use working capital to estimate funding needs

Working capital and the working capital ratio provide useful snapshots, but SMEs often need a deeper look at net working capital (NWC), especially when short-term debt makes up a large portion of liabilities.

Basic Net Working Capital Formula

NWC = Current Assets – Current Liabilities

Adjusted NWC (when short-term debt is high)

Adjusted NWC = Current Assets – (Current Liabilities – Short-Term Debt)

New Example

A business has:

• Current assets: R480,000

• Current liabilities: R450,000

• Short-term debt included in liabilities: R90,000

Working Capital = R480,000 – R450,000 = R30,000

Now calculate the adjusted figure:

Adjusted NWC = R480,000 – (R450,000 – R90,000)

Adjusted NWC = R480,000 – R360,000 = R120,000

Even with a healthier adjusted figure, the business still only has R30,000 of real working capital — a very thin safety net.

This type of business may benefit from:

• A working capital facility

• Bridging finance

• Invoice financing

• A revolving credit solution

• Seasonal funding

These tools help stabilise operations and protect the business during high-demand or slow-payment periods.

Strengthen Your Working Capital with the Right Funding Structure

Working capital determines whether your business can maintain momentum, meet obligations, and take on new opportunities. But many SMEs experience challenges when they need fast access to capital — especially during growth seasons or delayed customer payments.

When assessing external finance options, look for a funding partner that:

• Understands SME cash cycles

• Offers fast decision-making

• Cuts down paperwork

• Provides clear, transparent pricing

• Supports businesses with varied income patterns

• Offers products suited to both short-term and medium-term needs

Access to the right working capital solution can give your business the buffer it needs to trade confidently and grow sustainably.

If you need guidance on assessing your working capital or reviewing suitable finance options, a finance consultant can match you with the right funders based on your turnover, credit profile, industry, and cash-flow pattern.