Debt consolidation for low score clients tailors a financial solution that helps individuals with poor credit ratings manage their debts more effectively. This approach is particularly beneficial for those who find it challenging to obtain traditional loans due to their credit history. By consolidating multiple debts into a single, manageable monthly payment, clients can reduce their financial stress and work towards improving their credit scores.

Debt consolidation, in general, refers to combining all your debts into one monthly payment, aiming to reduce your monthly payments and save on interest. The most common method is through a debt consolidation loan, but it’s not suitable for everyone.

The Debt Consolidation Loan

A debt consolidation loan means taking on a new loan to pay off existing debts, consolidating them into a single loan. This sounds straightforward, but there are challenges:

New Credit Application Requirements: A debt consolidation loan is a new credit application. Therefore, you must meet all the minimum criteria, including a debt-to-income ratio of 1/3rd of your salary. If you’re already over-indebted, you might not meet this requirement.

Loan Limits: In South Africa, debt consolidation loans are limited to R300,000. Many people have debts exceeding this amount, so a loan might not cover all your debts, leaving you with multiple creditors and higher interest rates.

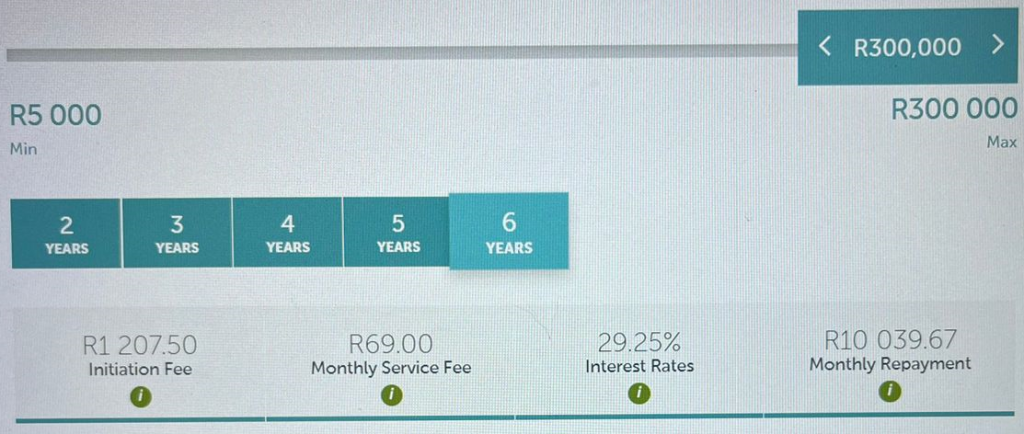

High Repayment Costs: Let’s take an example from Direct Axis. A loan of R300,000 repaid over six years at an interest rate of 29.25% per annum totals R722,856.24. You end up paying more than double the initial amount borrowed, making this an expensive debt consolidation option.

An Alternative: Debt Restructuring

Fortunately, the National Credit Act offers a better solution for over-indebted clients: debt restructuring. Here’s how it can help:

Higher Debt Limits: Consolidate debts from R100,000 to R2,000,000.

Single Monthly Payment: Pay one monthly amount, calculated after considering your living expenses.

Lower Interest Rates: Reduce your interest rates to as low as 9%, and in some cases, you might pay 0%.

No Upfront Fees: There are no upfront fees, and no need to find extra money in your budget. Your current debt payments will cover the monthly repayment, allowing you to pay less towards your debt and keep more cash in your pocket each month.

Inclusive for All: This solution is available to anyone who is over-indebted, including self-employed clients, commission earners, and weekly paid individuals typically excluded from loan applications.

All Credit Scores Welcome: This is not another loan but a way to consolidate your debt through restructuring. All credit scores are welcome as no new credit application is needed.

Take Your Free Assessment

If you’ve been rejected for a loan and want to consolidate your debt, this approach could be your best option. We invite you to chat with our team and take a free assessment to see how debt consolidation for low-score clients can change your life.

Transform your financial situation with debt consolidation tailored for low-score clients and regain control of your financial future.

There’s no obligation to sign up. Take this step and discover what your new future could look like.

Complete the form now, and our team will contact you.